Latin America is a region that blends youth, digitalization, and immense economic potential with challenging structural realities. With a combined GDP of $6.4 trillion and technology adoption rates comparable to those of the United States and China (Atlantico, 2024), the region is poised for profound economic transformation. However, operating here requires navigating high real interest rates, limited infrastructure, and fragmented markets.

Those who can master these complexities have a distinct advantage. Massive digitalization, combined with a resilient entrepreneurial ecosystem, is creating unique opportunities for Limited Partners (LPs) and the most astute investors. This is not a market for improvisation: success here depends not merely on abundant capital but on deploying adapted strategies.

An Ecosystem That Demands New Rules

Investing in startups in Latin America is not about replicating Silicon Valley in Spanish or Portuguese. Success stories here are less frequent but no less profitable. While the United States averages 55 IPOs per year, Latin America barely reaches 4.6 (Wilmer Hale, 2024). Nevertheless, Brazilian venture capital funds, for example, outperform their US counterparts, with a MOIC of 2.60x compared to 2.11x (Atlantico, 2024).

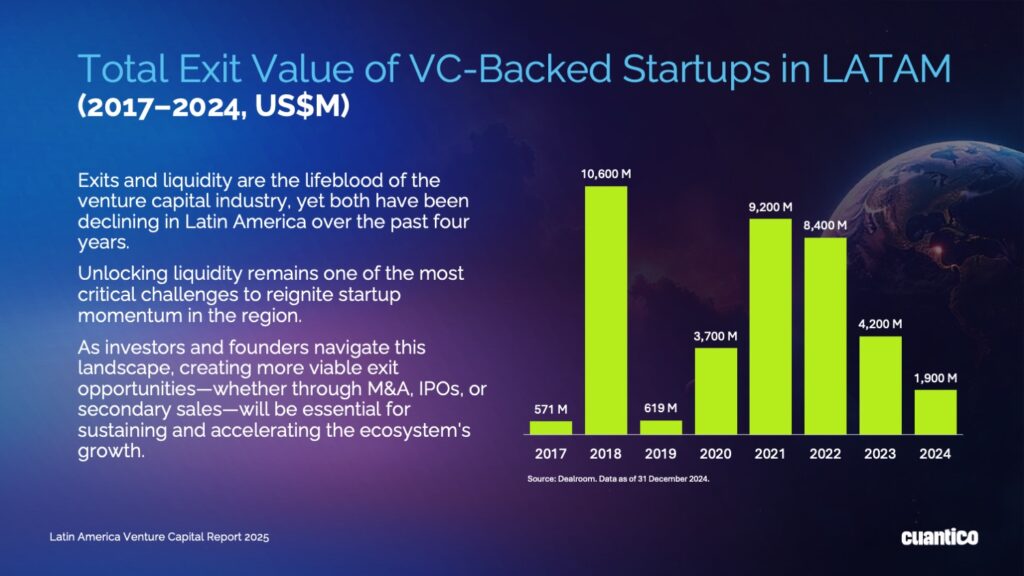

Yet, today’s most critical challenge is liquidity. According to our report “Latin America Venture Capital 2025“, only 79 exits have been recorded among venture-backed startups between 2017 and 2024. The number of acquisitions and IPOs has steadily declined since 2021, undermining reinvestment capacity and putting ecosystem growth at risk.

The “Camel” Philosophy: Doing More with Less

In environments where capital doesn’t flow freely, “camels” outperform “unicorns.” While Silicon Valley rewards hypergrowth at any cost, in Latin America, efficiency, resilience, and early profitability are the currencies of success (Lazarow, 2020).

The numbers speak clearly. Top SaaS startups in the region achieve CAC payback periods of just 1.6 months, compared to 4.8 months in the United States. Additionally, the Lifetime Value (LTV) to Customer Acquisition Cost (CAC) ratio is twice as high in LATAM compared to the US (SaaSholic, 2024).

Real-world examples reinforce these metrics. Clicksign in Brazil achieves CAC payback in under six months, compared to over six years for DocuSign (TechCrunch, 2024). Kriptos from Ecuador has scaled its AI cybersecurity solutions into twelve countries without inflating its operational footprint (BuenTrip Ventures, 2024).

The Liquidity Challenge and the Future of Funds

The lack of successful exits has triggered a “VC Winter” in Latin America. Total exit value has dropped significantly since 2021. Unlocking liquidity through flexible acquisition strategies and market consolidation is now imperative.

Despite these obstacles, venture capital activity remains strong, especially in markets like Mexico ($792M), Argentina ($418M), and Colombia ($353M) (Cuantico VC, 2025). These countries lead both the conversation and capital attraction in 2024, even as investment has declined in most other Latin American markets.

Furthermore, 189 VC firms have raised funds for Latin America between 2017 and 2024, but fundraising cycles are becoming longer (Cuantico VC, 2025). Future success will largely depend on managers who raised their first funds between 2021 and 2023 and must now deliver results to secure a second vehicle.

Source: Latin America Venture Capital Report 2025, Cuantico VC.

How Strategic LPs Are Investing in the Region

LPs (Limited Partners) have realized that playing strategically is crucial in this market. Success in Latin America does not depend on backing the “next Uber.” It is built by betting on:

Meaningful early ownership: Those who invest at pre-seed and seed stages secure strategic positions before risk dilutes, entering at reasonable valuations alongside teams building market-adapted solutions.

Capital efficiency as a mantra: Startups that manage every dollar wisely are the ones that survive and thrive. With the rise of AI, many startups are integrating it as a tool to enhance efficiency, raising only the capital they truly need, and expanding without significantly increasing costs.

Community investment: In the region, access to trusted networks and collaboration can mean the difference between success and failure. These companies not only build valuable solutions but also generate a positive impact in their surrounding communities.

According to Jose Kont, CEO at Cuantico VC and Venture Partner at Impacta VC:

“When your purpose is aligned with a long-term vision, every dollar invested creates exponentially greater impact and returns. $500K for a small company in New York might cover just a few weeks or months of expenses. The same amount in Latin America can allow an efficient team to operate for a year or more, developing high-value solutions that benefit not just the startup but entire nations. One portfolio example is Retorna, a remittance fintech that, after its seed round, created the first digital remittance solution for Venezuela, enabling thousands across Europe, Colombia, and other markets to safely send money to their loved ones.”

Key Considerations for Smart LPs

Investing in the region requires understanding and accepting:

Longer liquidity horizons (10+ years).

Exposure to macroeconomic volatility.

The need for flexible exit strategies: regional M&A, alternative IPOs, and secondary markets.

Successful funds nurture startups that don’t just survive but thrive under constraints. As an LP, your best bet is to partner with managers already embedded in local ecosystems, those who understand cultural nuances and are committed to working alongside founders, not merely financing them.

An Opportunity for the Bold

Latin America offers fertile ground for those willing to unlearn the traditional venture capital playbook. It requires a more pragmatic, patient, and value-creation-focused approach.

If you are seeking extraordinary returns in a market with less competition and immense potential, then Latin America is not just an option—it is the next strategic move you should seriously consider.

Are you ready to invest where others only see risk?

Originally featured in Pulso Capital, this article was first published in Spanish.

References

Atlantico. (2024). Latin America Digital Transformation Report 2024. Atlantico.

BuenTrip Ventures. (2024). Navigating Venture Capital in Latin America: A Guide for LPs. BuenTrip Ventures.

Capchase. (2023). The Capchase SaaS Benchmark Report 2023. Capchase.

Cuantico VC. (2025). Latin America Venture Capital Report 2025. Cuantico VC.

LAVCA. (2024). Mid-Year 2024 Industry Data & Analysis. Latin American Venture Capital Association.

Lazarow, A. (2020). Out-Innovate: How Global Entrepreneurs – from Delhi to Detroit – Are Rewriting the Rules of Silicon Valley. Harvard Business Review Press.

SaaSholic. (2024). State of SaaS LatAm 2024. SaaSholic.

TechCrunch. (2024). Why Latin American SaaS startups are different from their US peers.

WilmerHale. (2024). WilmerHale IPO Report 2024. WilmerHale.