Mexico’s Venture Capital Industry Sees Steady Growth Amid Global Challenges, Reaches Nearly $10 Billion in Funding Over the Last Decade

Mexico City, October 2024 – Cuantico, the premier research and communication firm for the venture capital (VC) industry in Latin America, proudly announces the release of the Mexico Venture Capital Report 2024, offering the most comprehensive analysis to date of Mexico’s dynamic VC ecosystem. This report, backed by valuable contributions from Startuplinks and the Central America Angel Fund Initiative (CAFI), provides a detailed look at the key trends, investment patterns, and future outlook for venture capital in the country.

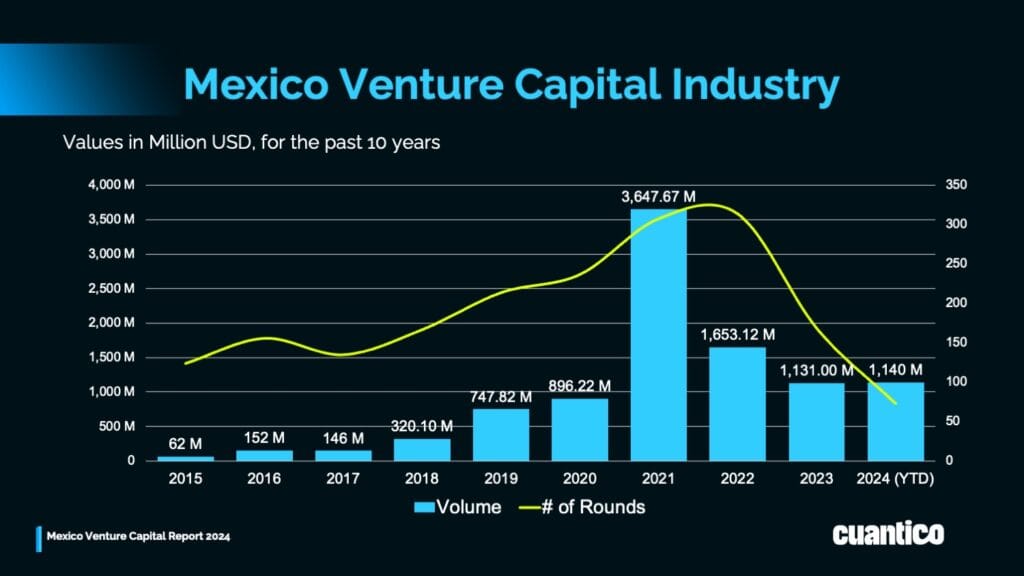

$9.89 Billion Raised in 10 Years

Over the past decade, Mexico has emerged as a leading hub for venture capital in Latin America, attracting both local and international investors. According to the report, Mexican startups have secured $9.89 billion across 1,897 funding rounds, solidifying the country’s position as a driving force for innovation and entrepreneurship in the region. Notably, the year 2021 saw the highest volume of investment, fueled by landmark deals such as Kavak’s $700 million Series E round, which remains the largest funding round in the country to date.

Fintech Leads the Way

Despite global economic challenges, including inflation and rising competition, Mexico’s VC ecosystem has shown remarkable resilience. As the report outlines, while the number of deals has decreased by 50% from 2022 to 2024, the volume of investment has remained steady. This is primarily due to larger funding rounds, underscoring a shift toward more substantial, focused investments as the market matures. Fintech continues to dominate as the leading sector, capturing 60% of total VC funding between 2022 and 2024, followed by Autotech, RetailTech, and LogTech.

Mexico’s Role in the LATAM VC Landscape

The report also compares Mexico’s performance with other major Latin American markets. From Q1 2022 to Q3 2024, Mexico accounted for 18% of VC deal volume in the region, second only to Brazil’s dominant 46% share. Over 480 investors participated in funding rounds in Mexico during this period, highlighting the country’s growing importance as a VC destination in Latin America.

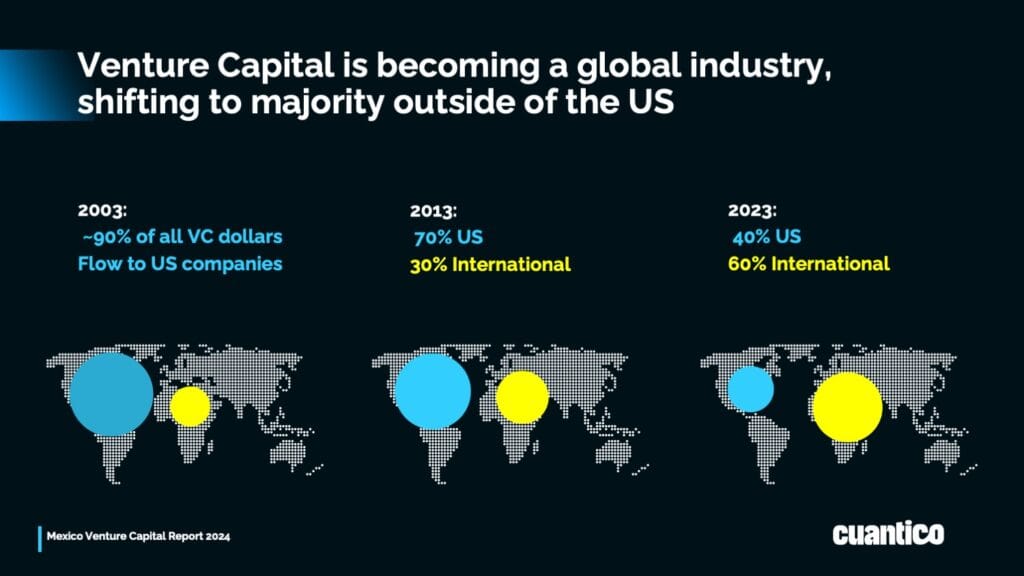

Global Shift: VC Investment Expands Beyond the US

The Mexico Venture Capital Report 2024 highlights a significant global shift in VC investment patterns. In 2003, nearly 90% of all venture capital was funneled into U.S.-based companies. Fast forward to 2023, and the global VC landscape has transformed, with more than 60% of venture capital now directed toward international markets. This shift reflects the growing importance of emerging markets, like Mexico, which have become attractive destinations for investors seeking new opportunities and high growth potential. Latin America, and particularly Mexico, is now positioned at the forefront of this global expansion, as it continues to develop a thriving entrepreneurial ecosystem.

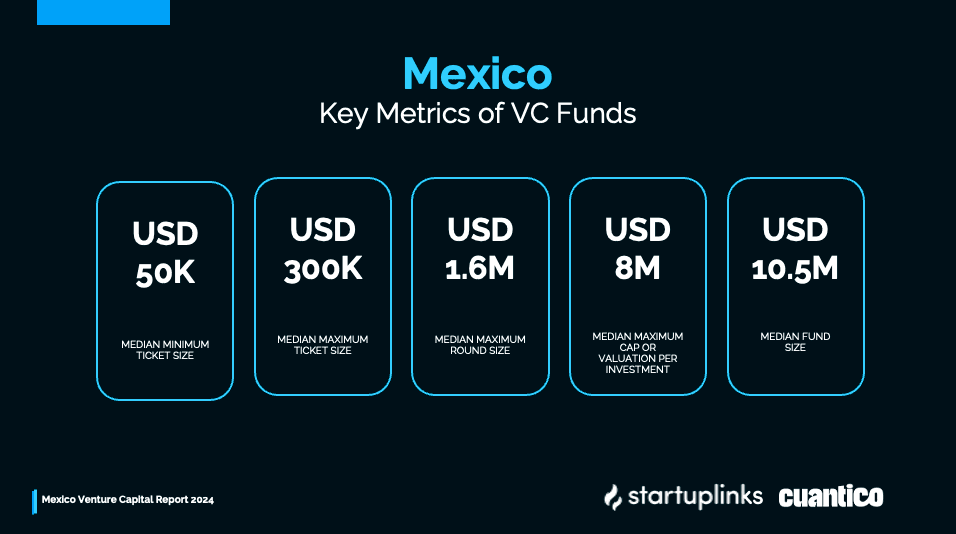

Key Metrics of Mexico’s VC Funds

The report provides detailed insights into the characteristics of venture capital funds in Mexico. The median minimum ticket size is around $50,000, while the median maximum ticket size reaches $300,000. On the higher end, the median maximum round size for startups is approximately $1.6 million, and the median maximum valuation per investment stands at $8 million. These figures highlight the diversity of capital deployment in the country, with both early-stage and growth-stage investments actively fueling innovation. Additionally, the median fund size for VC firms in Mexico is $10.5 million, illustrating the robust investment environment supporting startups across multiple sectors.

Looking Ahead: Mexico’s Future as a VC Hub

Jose Kont, Executive Director of Cuantico, remarked, “Mexico has proven itself as one of the most exciting markets for venture capital in Latin America. The strength of the ecosystem lies not just in the volume of capital raised but in the depth and diversity of startups emerging from the country.” As Mexico’s venture capital industry continues to evolve, the report indicates that the country is poised to remain a central player in the region’s innovation economy.

About Cuantico

Cuantico is the leading research and communication firm specializing in the venture capital industry in Latin America. Our mission is to support the growth of VC ecosystems across the region, accelerating innovation and economic advancement through data-driven insights and strategic communication.