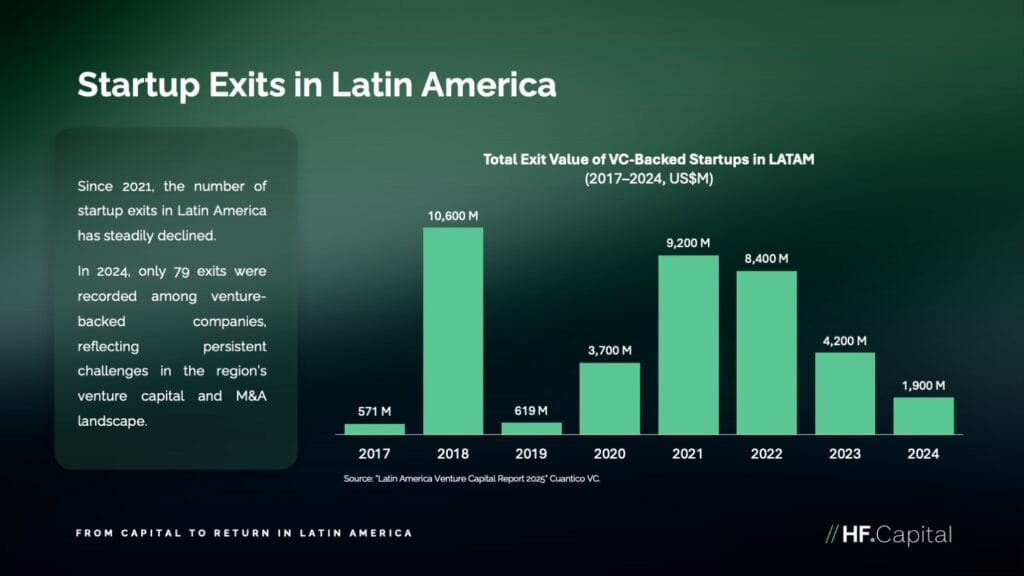

San Jose, California, USA – May 20, 2025. Unlocking liquidity and strengthening the investment markets for startups, venture capital, and innovation in Latin America is not only possible—it is urgent for accelerating the region’s economic development. However, achieving this requires coordination among multiple stakeholders and the implementation of complementary strategies across various time horizons.

This report outlines actions ranging from short-term measures—such as the development of secondary markets and the promotion of a stronger exit culture—to long-term initiatives like regulatory adaptation to enable pension fund participation and sustained efforts to improve the region’s global reputation as an innovation investment destination.

Preview of the 12 recommended strategies in the report:

The path toward a more liquid and dynamic ecosystem does not rely on a single solution but rather on the sum of strategic and sustained efforts. The proposals presented here offer a concrete roadmap toward one of the most transformative and necessary shifts for Latin America: the creation of an environment that facilitates capital flow, drives innovation, and generates long-term growth opportunities.

Click here to Access the Full Report in English

About HF Capital:

HF Capital supports funds and startups across Latin America in accessing capital markets by simplifying the IPO process. With hands-on experience in public offerings, SEC advisory, and connections to over 28 stock exchanges, we work to modernize access to financing—ensuring that emerging companies and early-stage investors gain the liquidity they deserve.

About Cuantico:

Cuantico is a research firm specializing in the venture capital industry in Latin America. Through our reports, radars, and investment maps, we document the evolution of the region’s investment and innovation landscapes.