The second quarter of 2025 will be marked in the annals of Latin American entrepreneurship as an unusual moment in the regional venture capital geography. For the first time since 2012, Mexico surpassed Brazil as the main recipient of quarterly venture capital investment, strengthening its position as an entrepreneurial powerhouse in Latin America with USD 437 million raised.

This milestone represents a transformation in regional investment dynamics that merits a detailed analysis of its implications and structural foundations.

VC Sector Figures in Latin America During 2025

Mexican startups raised $437 million in the second quarter, marking an 85% year-over-year increase and an 81% jump from the previous quarter. Brazilian startups secured $350 million, representing a 23% year-over-year decline and a 14% drop compared to the first quarter.

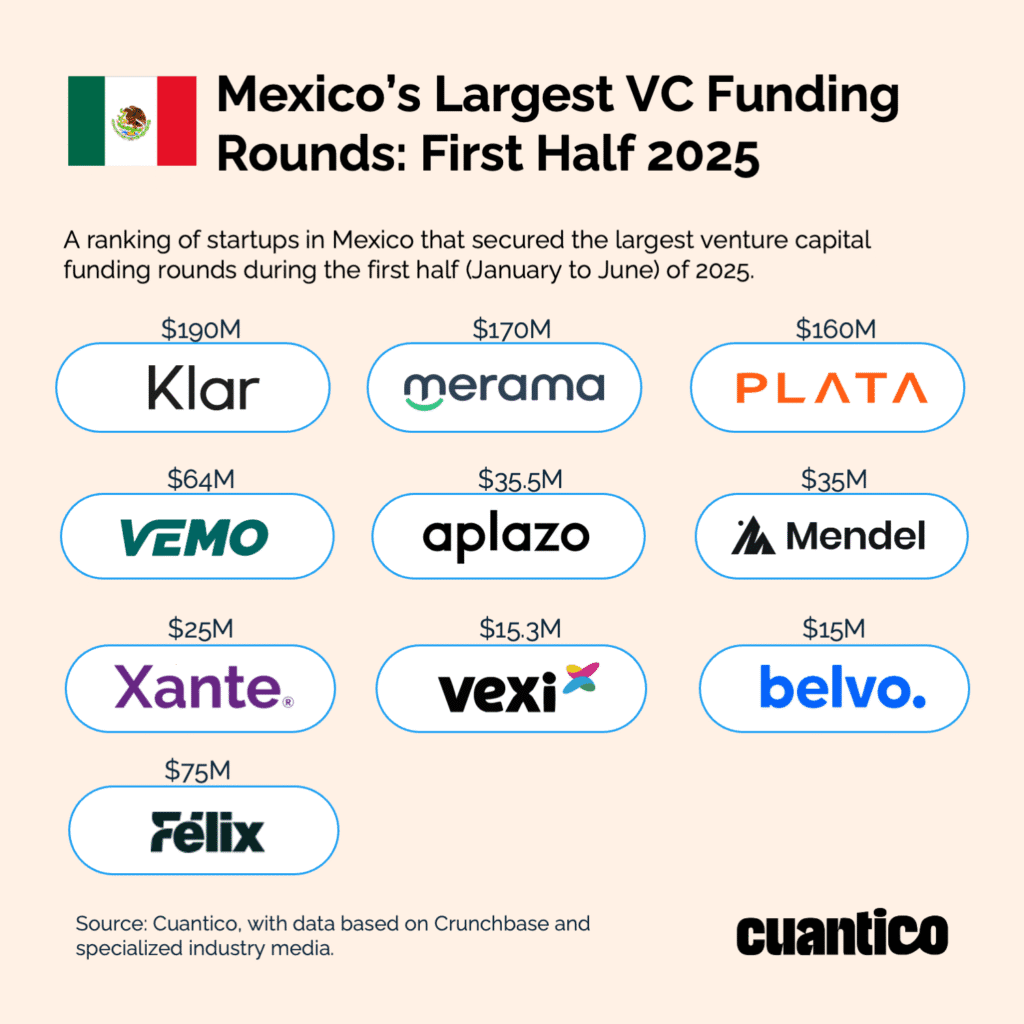

The largest funding round in Mexico—and Latin America overall—was announced on June 30, the final day of the quarter. This was a $190 million Series C round for Mexico City-based fintech startup Klar, considered Mexico’s largest digital bank, which valued the company at $800 million.

A surge in late-stage and growth funding helped propel the region during this period. According to Crunchbase data, Latin American startups raised a combined $961 million across seed-through-growth-stage deals in the second quarter, representing a 16% year-over-year increase and 13% growth compared to the first quarter.

Of that total, $547 million went toward late-stage and growth deals, marking a substantial 102% year-over-year increase. This figure is nearly double the $273 million in late-stage and growth financing the region recorded in the first quarter of this year.

Data Perspective from Cuantico

Cuantico’s data provides a crucial perspective for understanding this phenomenon. According to our 2025 report, Mexico managed to raise USD 792 million during all of 2024, consolidating itself as the second-largest venture capital market in Latin America after Brazil (USD 1.7 billion) and above Argentina (USD 418 million).

However, we identify a concerning pattern that contextualizes the Mexican victory: only 79 exits were registered among VC-backed companies throughout the region, evidencing a serious liquidity problem. This scarcity of successful exits has created what experts call the Latin American “VC Winter,” where the lack of exits limits reinvestment capacity and sustains vicious cycles of dependence on international capital.

Our report also reveals that between 2017 and 2024, 189 venture capital firms raised funds for Latin America, of which 106 secured capital between 2021 and 2023. With average fundraising cycles of three years, many of these firms will return to the market in 2025-2026, suggesting a potential new wave of regional investment.

The New Investment Paradigm

The ecosystem transformation goes beyond quarterly numbers. Insights recently compiled by Crunchbase reveal a fundamental change in the approach toward Latin America. Miguel Armaza from Gilgamesh Ventures argues that many investors who withdrew from the region were “tourists” without real commitment, while truly committed funds maintain their activity.

Mike Packer from QED Investors identifies a crucial strategic evolution: “companies are trying to think bigger earlier” due to the liquidity cycle and general lack of exits. This early scaling mentality is driving companies like Ebanx and dLocal to expand toward Africa and Asia, demonstrating global ambition from Latin America.

Nicolas Szekasy from Kaszek also offers an optimistic perspective on the region, highlighting that “our firm’s investment pace has accelerated in 2025 compared to the previous two years.” His observation about the resilience of Latin American founders—building through volatility for decades—suggests unique competitive advantages that other ecosystems do not possess.

The AI Factor and Early Investment

An emerging trend identified by both Crunchbase and Cuantico data is the predominance of startups with artificial intelligence components. Brian Requarth from Latitud acknowledges that “almost every investment we’ve made in 2025 has some AI angle.” This convergence between Mexican growth and the AI revolution suggests that the country is strategically positioning itself in future technologies. In fact, when analyzing the top 10 Seed Rounds throughout Latin America, we see that AI startups are beginning to stand out.

Simultaneously, data shows that top SaaS startups in Latin America achieve CAC (Customer Acquisition Cost) payback periods of only 1.6 months, compared to 4.8 months in the United States, with LTV/CAC ratios twice as high in Latin America. This operational efficiency represents the “camel” philosophy over the “unicorn”—doing more with fewer resources.

Mexico’s victory over Brazil in Q2 2025 represents more than a statistical change; it symbolizes the dynamism of diverse paradigms in Latin American venture capital. With solid fundamentals, a global scaling mentality, and the momentum of emerging technologies like AI, Mexico is demonstrating that it can not only compete with Brazil, but establish new standards for the entire regional ecosystem.

The real test will be the sustainability of this leadership and the Mexican ecosystem’s capacity to resolve the fundamental challenge identified in our 2025 report: creating more exits that allow for a healthy cycle of reinvestment and self-sustaining growth.