The ecosystem faces liquidity challenges as investors adjust their strategies

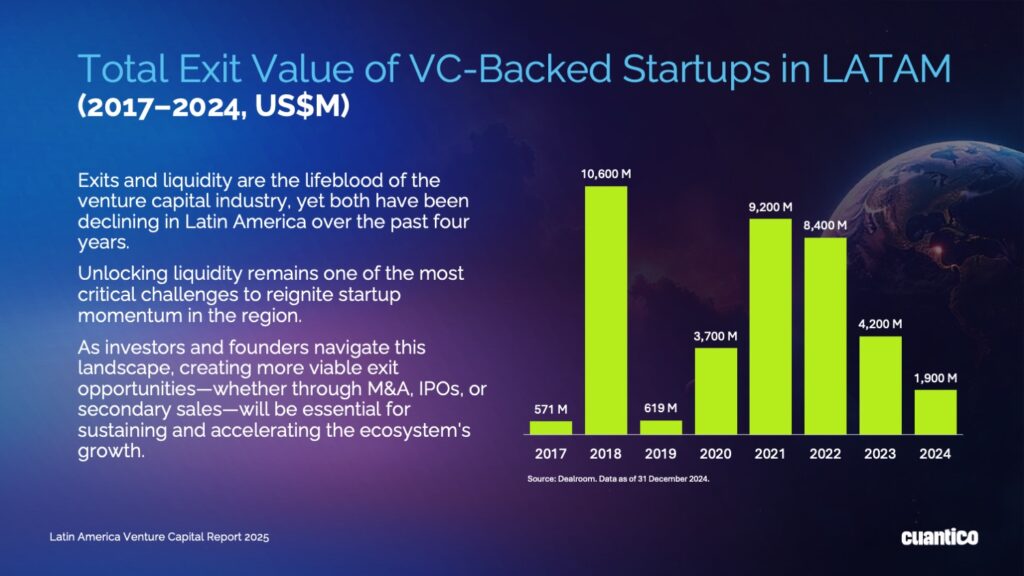

Mexico City, March 6, 2025 – Cuantico, a firm specializing in Venture Capital research, presents its latest report, “Latin America Venture Capital Report 2025,” analyzing the evolution of venture capital in the region. With only 79 exits recorded among VC-backed companies, the ecosystem faces a major challenge: the lack of liquidity.

Link to Download and Access the Full Report

As investors shift their focus toward profitability and long-term sustainability, the number of acquisitions and exits has steadily declined since 2021. Without viable exit opportunities, the growth of the startup ecosystem could be significantly impacted in the coming years.

Exits and Liquidity: The Ecosystem’s Biggest Challenge

Successful exits—whether through mergers and acquisitions (M&A), IPOs, or secondary sales—are essential to the Venture Capital lifecycle. However, over the past four years, liquidity has been steadily declining, limiting investors’ ability to reinvest in new startups and sustain a self-sufficient ecosystem.

In this context, unlocking liquidity has become a top priority. Without viable exit opportunities, both investors and entrepreneurs must explore innovative alternatives to maintain the ecosystem’s viability, including more flexible acquisition strategies and market consolidation.

Mexico, Argentina, and Colombia Lead the Venture Capital Conversation

Despite industry challenges, interest in Venture Capital remains strong in Latin America. Mexico, Argentina, and Colombia are the three Spanish-speaking markets with the highest level of discussion around the industry, generating the most engagement across social media, news outlets, and industry reports.

At the same time, they are among the leading markets for venture funding in 2024, collectively capturing a significant portion of the region’s total investment:

- Brazil: $1.7 billion

- Mexico: $792 million

- Argentina: $418 million

- Colombia: $353 million

This trend highlights not only the growth of these entrepreneurial ecosystems but also their ongoing attractiveness to investors. However, despite the conversation around VC, the reality is that funding declined in most Latin American countries in 2024, with only Peru, Colombia, and Argentina seeing an increase compared to 2023.

The Future of Venture Capital in the Region: Funds in Transition

Cuantico’s report also reveals that between 2017 and 2024, 189 Venture Capital firms raised funds for Latin America. Among them, 106 secured capital between 2021 and 2023, including some of the region’s leading VC firms.

With an average three-year gap between fundraising cycles, many of these firms are expected to return to the market in 2025-2026, potentially driving a new wave of investment in the region. However, the future of the ecosystem will largely depend on fund managers who raised capital for the first time and must now decide whether to pursue a second fund.

Cuantico’s data indicates that the 2021 surge in new VC funds was driven by favorable macroeconomic conditions, low interest rates, and accelerated digitalization. However, since 2023, the market has become significantly more cautious, making it increasingly difficult for new VC firms to raise capital.

The “VC Winter” and the New Reality for Investors

Link to Download and Access the Full Report

The so-called “VC Winter” has not only been driven by declining liquidity but also by several key factors:

- Rising interest rates

- Market hostility toward IPOs and M&A activity

- Increased pressure to demonstrate financial sustainability

While investors remain active, their approach has changed drastically. They are now prioritizing startups with proven early traction, sustainable financial models, and efficient resource management, often leveraging AI-driven optimization technologies.

This shift in investment strategy has also impacted startups’ ability to reach billion-dollar valuations. Since 2021, the number of unicorns in Latin America has been steadily declining, and in 2024, only one company—Agibank—achieved unicorn status, reaching a valuation of $1.5 billion.

The Latin American Venture Capital ecosystem is undergoing a transition. While the era of hypergrowth is over, the market is adjusting to a new paradigm in which sustainability and long-term strategy will be the key pillars of success.

“The lack of exits is the biggest challenge facing Venture Capital in the region. Without liquidity, the ecosystem loses momentum, making reinvestment more difficult. However, market maturity and financial discipline could lay the groundwork for more sustainable growth in the coming years,” concludes Cuantico’s report.